Van Lanschot Kempen introduces new private equity fund focused on secondaries

Van Lanschot Kempen Investment Management introduces the Private Equity Secondaries Evergreen Solution today. This fund focuses on acquiring existing private equity stakes in the secondary market (secondaries). In this market, existing stakes are acquired from other private equity investors, allowing new investors to invest in companies that are developed yet still show sufficient growth potential.

Wendy Winkelhuijzen, Member of the Management Board of Van Lanschot Kempen, responsible for Private Banking Netherlands: “We continuously expand the offering of our private market solutions to meet the strong interest from our clients. This was evident from the successful closing of our third European private equity strategy. Investing in secondaries offers our experienced investors, such as high-net-worth individuals and entrepreneurs with a long-term focus, further diversification in their private equity portfolio. Additionally, investments in this fund are made more quickly, resulting in a shorter investment cycle compared to traditional private equity investments through the primary market.”

Private Equity Secondaries Evergreen Solution is an evergreen private equity structure, meaning that payouts from underlying investments are reinvested. The fund has a cooperative structure that is attractive for Dutch investors, as it allows for the use of the participation exemption. Participants have the option to enter on a quarterly basis and, after a lock-up period of three years, also exit, depending on available liquidity. The fund invests in private equity funds in combination with co-investments. This contributes to the goal of creating a diversified portfolio across different sectors and regions. The addition of co-investments helps to reduce costs and accelerate the deployment of capital.

Sven Smeets, Head of the Private Equity Strategy at Van Lanschot Kempen Investment Management: “This new fund specifically focuses on secondaries, where the specialists we select add value to medium-sized companies through improvements in operations and strategy, further professionalisation, and internationalisation. The fund is actively managed by a team of experienced specialists and thanks to our extensive network and expertise, the fund has access to investments that private investors normally do not have direct access to.”

This is a marketing message.

Private Equity Secondaries Evergreen Solution (the "Fund") is a sub-fund of the Kempen Umbrella II Coöperatief U.A. (the "Umbrella Fund"), domiciled in the Netherlands. Van Lanschot Kempen Investment Management NV (VLK Investment Management) is the manager of the Umbrella Fund. VLK Investment Management is authorised as a management company and regulated by The Netherlands Authority for the Financial Markets. The Sub-Fund is registered under the license of the Fund at the Netherlands Authority for the Financial Markets.

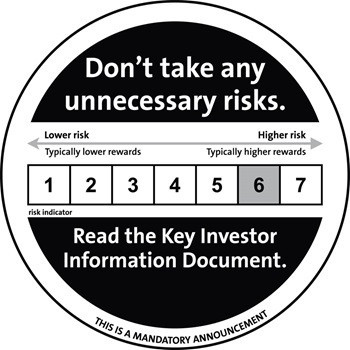

The information in this document provides insufficient information for an investment decision. Therefore, read the prospectus and the Essential Information Document. These documents of the Fund are available on the website of VLK Investment Management (www.vanlanschotkempen.com/en-nl/investment-management/investment-strategies). The information on the website is (partly) available in Dutch and English. The Sub-Fund is registered for offering in a limited number of countries. The countries where the Sub-Fund is registered can be found on the

website.

Risk classification EID: Because the value is calculated only once a quarter, the risk indicator is classified in class 6 and the likelihood of potential losses assessed as high.

Sustainability: SFDR article 6

The Fund doesn’t have an end date and is aimed at well-informed investors only.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Past performance provides no guarantee for the future.

This press release does not constitute an offer or solicitation for the sale, purchase or acquisition in any other way or subscription to any financial instrument and is not a recommendation to perform or refrain from performing any action.

This press release is a translation of the Dutch language original and is provided as a courtesy only. In the event of any disparities, the Dutch language version will prevail. No rights can be derived from any translation thereof.